Take the next step in your career path.

Career advice, diverse stories, and more

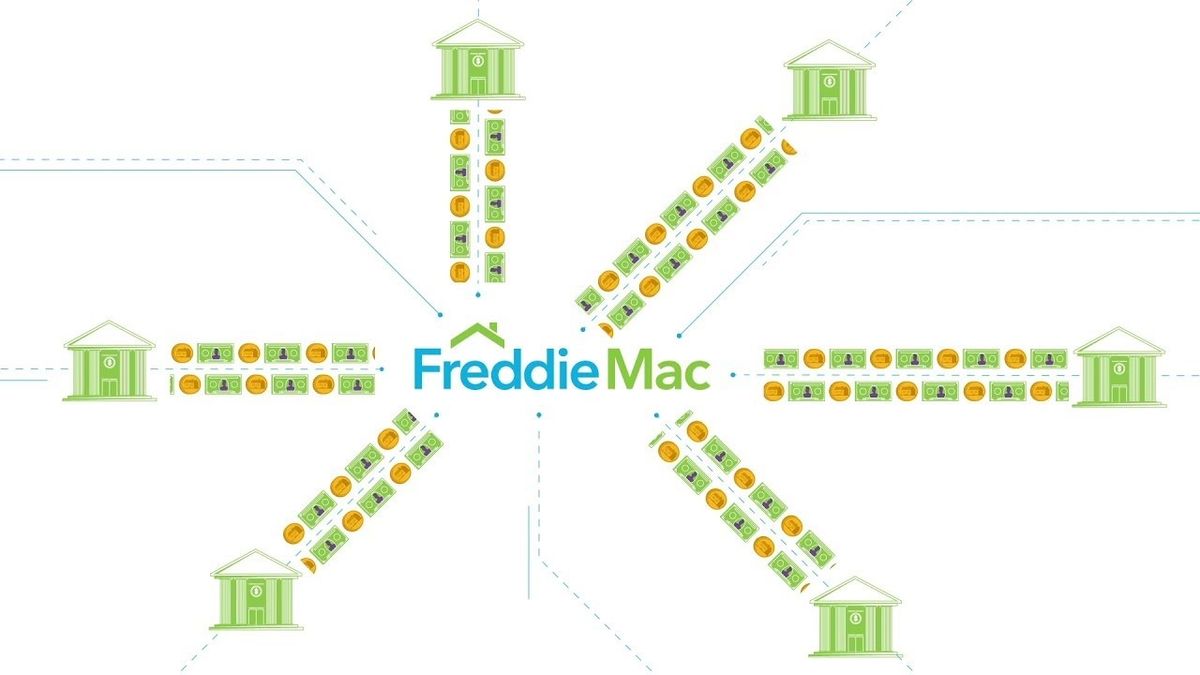

Articles about working at freddie mac

Articles about working at freddie mac

Load More

Get email updates from PowerToFly

Our Company

Popular Jobs

Popular Remote Jobs

Popular Jobs Locations

© Copyright 2024 PowerToFly